Inflation in Motor Claims continues to be the hottest topic in the sector since we published our original article (“Motor Claims: Market forces take the driving seat”) in February 2022. At that time, most recent data from WTW’s Claims Metrics service suggested claims inflation increased by 6.1% for UK motor insurers during the first half of 2021. The half year report cards from insurers in 2022 suggests it has got much worse: Direct Line has reported inflation at 10% and Sabre at 12%, according to Bloomberg Intelligence. Procurato’s market insight suggests this is the new norm, with some having a much tougher time.

With commuting levels down in 2021 UK motor insurers were still able to achieve a Net Combined Ratio of 96.6% according to a report by EY. In February we reported predictions suggesting 2022’s figures will be a loss-making 113.8% NCR [Footnote 1]. Our recent discussions with senior Motor Claims leaders suggest this is realistic at best.

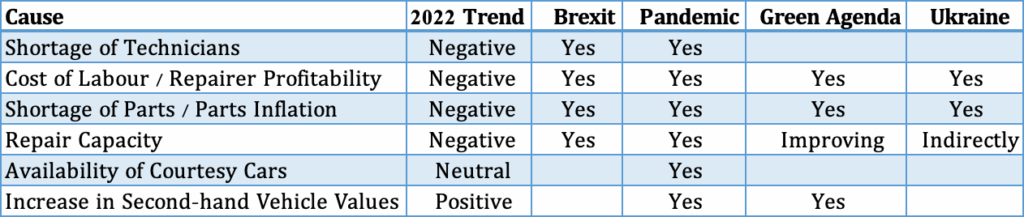

The pandemic, Brexit, and the green agenda have added considerable additional costs to motor claims with many insurers admitting that they haven’t budgeted for these levels of claims inflation. The Association of British Insurers have warned that ‘cost pressures‘ are likely to cause premiums to rise by 2% in 2022 and a huge 18% in 2023 causing additional financial problems for consumers who are facing higher costs of living in the wake of soaring fuel and energy prices.

Customers continue to take to social media to vent their frustration about repair lead times. It is now taking between 30 and 40 days on average just to book roadworthy vehicles in for repair and even then, there is no guarantee that parts will be available. Some insurers have taken to applying temporary repairs to keep customers mobile.

Richard Reed, EY’s UK General Insurance Market Lead says that “looking ahead, there are significant challenges on the horizon. Consumer premium rates have remained fairly low and are far below the level needed to keep pace with inflation… this means the 2022 and 2023 environment will be tough.”

Matthew Parker, Managing Director at Procurato says “I predicted in February that the future wasn’t looking brighter for the rest of 2022. If anything, the storm has intensified significantly. The is a greater shortage of labour, parts, and courtesy cars, which has extended lead-times by around 10 days in a quarter, and cycle time by more. There is huge pressure on servicing customers and managing indemnity spend. From a procurement perspective, it’s still unbelievably tough out there”.

So, what’s causing these substantial price hikes and what solutions are there to this ever-increasing cost challenge?

The root causes

The impact of the combination of the factors in the table above are undoubtedly driving inflation in indemnity and operational expense, putting pressure on customer service and strain the resilience of insurers to serve their customers. Moreover, we’ve now started to see that flow through into Insurers’ Combined Operating Ratios and profitability. Let’s explore why.

Labour Challenges

As with many other industries repairers are experiencing labour shortages and the ‘Great Resignation’ is in play. A recent automotive aftermarket survey indicates that 90% of automotive leaders says workshop and technical roles are the hardest vacancies to fill. Reviewing the vacancies on AM Online on 1 August, 2022 there are 27 pages of vacancies for the repair sector, amounting to c670 jobs available.The lack of experienced and qualified technicians mean that repairers are having to pay more to keep their best people – leading to wage inflation.

The cost of labour and thus repairer profitability is putting pressure on labour rates. In the last three months alone labour rates have increased by as much as 21%. This means insurers may be selected against if they’re not paying enough. In addition, a rate increase for repairers doesn’t guarantee priority through the body shop, as it once might have done. With other factors affecting the physical ability of repairers to progress repairs on vehicles, insurers risk paying merely to join the “awaiting parts” queue. There is also the pressure for repairers to be paid promptly. Cashflow has become critical to them, so insurers need to flex their support and ensure their outsourced partners treat repairers fairly. Strong relationships and trust are more important than ever.

Parts Shortages, increasing costs and the value of second-hand vehicles: The global supply chain disruption is well documented, and it’s impacted the auto industry hard. Insight from a national repair group is indicating that parts shortages across all brands of cars are a major nationwide issue. Some insurers are even asking repairers to undertake temporary repairs to keep customers roadworthy whilst the parts are on backorder. However, this will cause challenges further down the line when these temporary fixes lead to vehicles becoming unroadworthy and the body shops won’t have capacity to deal with them.

Anecdotally, Procurato has been told that 40% of all work in progress (WIP) has been affected by some form of parts delays. Common models, where previously original or equivalent parts were available on 24–48-hour delivery, are now stuck in body shops or awaiting a realistic booking-in date. An example given was the back-order delay for a Vauxhall Zafira back axel, where the current lead time is over 12 months.

Another common message we are hearing is about severe shortages for electronics parts for German vehicles in particular. This is partly because of the global semi-conductor shortage which has created huge demand for the essential components in smart headlights like Mercedes’ Digital Lights but is exacerbated by the war in Ukraine. Whilst manufacturers are making huge strides to increase capacity through the building of new facilities this will take time. Taking that into account alongside continued global shipping delays and the fact that microchips are used in many other industries, we believe that despite some analysts suggesting the shortages will be over by Q3, 2023 we think it will more likely be 2024 before demand and supply equilibrium occurs.

Marques such as Volkswagen, Porsche and BMW, whose supply chains rely heavily on manufacturers like Leoni, Fujikura and Nexans, have been badly impacted by the unavailability of wiring harnesses which were manufactured in Western Ukraine [2]. Inevitably, the bulk of available supply is going to new vehicle production, which has a downstream impact on repair parts availability and repair cycle times.

In addition to this, inflated oil prices and the ongoing conflict in Ukraine is increasing the cost of raw materials which go into body paint, so much so that this month ABP reported that Audatex confirmed that there is an average increase of 7.82% on paint materials.

Global auto-manufacturers such as Ford and PSA are taking control of their own supply chain forcing prices up for repair shops. Many manufacturers are also either changing the specifications of their new cars, saving their chips for their high value cars, or manufacturing them without the chips in the hope they will arrive soon.

Used Car Values: One positive change from an inflationary perspective since the last update has been the fall back in the inflation in used car prices as measured by the Office for National Statistics’ Consumer Price Index (CPI). At its peak in inflation in the monetary values of used cars increased from 1.2% in May to 7% in July [3]. Since that point it has been steadily declining to prepandemic levels. Whilst CPI is a lead indicator and doesn’t immediately translate to the price of a second-hand car on the dealership forecourt, there is a correlation. Autotrader [4] saw the inflation in July 2021 peak in average second-hand retail prices in January 2022, since when prices have been declining at a similar rate to CPI but with a six-month lag.

One saving grace has been the unseasonably dry weather conditions in the UK this year. This good weather coupled with people driving less due to the cost of living has naturally led to fewer accidents. However, Autumn and its darker, rainy days is incoming and the seasonal increase in repair work will shift the claims profile.

Courtesy Car Availability: There is a general shortage of cars because of the pandemic, which means that repairers and CHOs are struggling to lease vehicles. Also, longer repair times mean that customers are in courtesy cars for longer, which reduces the available vehicles, particularly where insurers have contracted repairers to provide a courtesy car for every customer with an unroadworthy vehicle. In these scenarios, the financial and contractual pressure on body shops is further exacerbated – there is a limit to the number of replacement vehicles they have on fleet, an increasing number deployed at one time, and contractual demands from insurers to provide vehicles they do not have. Either insurers need to fund additional vehicles, or body shops do – all of which ultimately puts financial pressure on the cost of claims.

As we mentioned earlier, whilst providing temporary repairs can be a short-term fix, this challenge will only come back later when those repairs need addressing fully. Lack of vehicle availability will also have an impact on credit hire.

Repair Capacity: Market capacity in the UK vehicle repair market is currently overwhelmed, with reports suggesting demand is sitting at 130% of capacity. The challenges we mention above are creating blockages in the repair process which is slowing jobs down with the average lead time taking up to 40 days for a roadworthy vehicle. In addition, because some parts are not available, unroadworthy vehicles (URW) are getting stuck in repairers, which means they cannot take in other work. As a result, some are rejecting URW cases, as on average their rely upon a fast schedule of broken cars in and fixed cars out. With workshops getting clogged up productivity and profitability reduces.

John Gaynor, Procurato Commercial Director, adds “As far back as I can recall, Motor Claims Supply Chain managers have been bracing themselves for a sudden contraction in quality repair capacity which didn’t materialise, until now. The best prepared that I’ve spoken with have been out of the blocks for several months now, not trying to mitigate the first wave of inflation but looking at how to manage the effects of the aftershocks which will extend into 2023.”

We are seeing moves by several smaller groups to fill that void. There is consolidation by acquisition from players like the Steer Group and the Redde Group, as well as significant investment in new sites by companies like Activate Group. Whether any of these players will reach the UK-wide scale of NARC remains to be seen, but there is undoubted cannibalisation of capacity through these moves. Add to that the recent acquisition of Hills Motors by Copart, which brings significant consolidation of salvage and green parts supply under one roof, and the changes will be making risk-averse, continuity-preferring insurers nervous as the landscape shifts beneath their feet.

The Bottom Line

- The emerging half-year results we are seeing indicates there may be severe premium rate corrections for any insurer who is heavily reliant on motor and has not been pricing the additional costs in incrementally. If this leads to reduced policy sales, the knock-on is reduced claims, which will expose insurer operational expenses in 2023. A subsequent drop in claims volumes would challenge influence over suppliers and exacerbate service challenges.

- There is currently little insurers can do about the macroeconomic and geo-political influences driving inflation. Where positive energy would be well spent is on looking forward to ensure commercial and operational resilience of supply can be sustained.

- There is the potential for further consolidation in the balance of power as major repair groups form and emerge, calling into question current terms and priority status, even in established insurers.

- There is a risk of supplier failure or withdrawal from contracts due to the rates on offer or payment terms. As a result, cashflow will become an even more important issue and will drive relationship management.

- Strong supplier management is needed in a situation where market rates are going to be significantly higher, despite the solid details.

These issues will present a risk to service continuity and indemnity.

Claims Directors are rightly feeling concerned about their own motor claim supply chain questioning whether they have the expertise to deal with these challenges alone or indeed just how bad these market forces are going to hit them. But the good news is, even if you haven’t reacted yet, it’s still not too late.

It’s vital that insurers review their motor claims processes immediately and identify any gaps that will could cause both financial distress and/or poor customer service. Our customers have been speaking to us about benchmarking to ensure they understand and can explain their position in the market. We’re also helping them to understand their business continuity and operational resilience positions whilst re-engaging with suppliers to seek assurance or by going to market early on expiring contracts to be sure they have service credit protection. We’re also exploring supplier diversification.

Parker concludes, “The motor insurers across the UK, that we have been speaking to, are all raising concerns about at least one element in their claims process. Regardless of how big or small that concern may be, we recommend you receive a second opinion. Claims inflation is likely to continue to rise and it’s important to take the time now to assess and verify your plans.”

The Procurato Way

We know how to manage these issues

Procurato consultants have over 30 years’ experience of managing issues like these and we are currently helping several clients to improve their supply chain. Speak to us to help you establish just how much of an issue this is going to be for you and how to manage it.

Market in detail

We have access to unique data and insights from across the whole market meaning we can help you to quickly understand where you benchmark in the sector and help you understand the steps you could take to improve.

Solutions are practical

We have the skilled expertise to support you contractually, operationally, and strategically. From offering insight to shape potential responses, through to hands-on execution of plans at pace, Procurato can help you address these challenges.

Resources

[3] https://www.ons.gov.uk/economy/inflationandpriceindices/timeseries/d7ly/mm23

[4] https://plc.autotrader.co.uk/press-centre/auto-trader-retail-price-index/